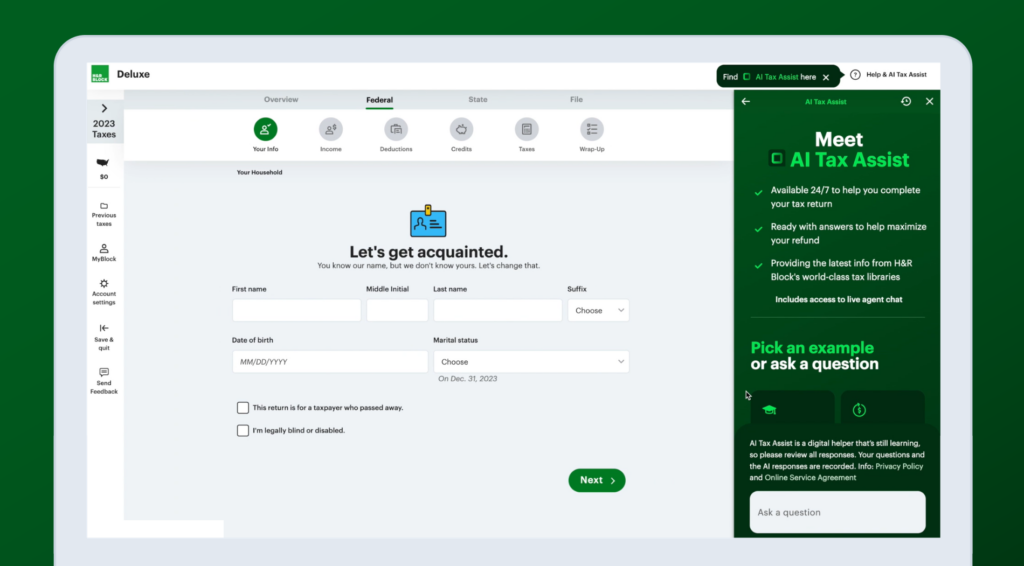

In a groundbreaking move poised to reshape the landscape of tax preparation, H&R Block introduces its latest innovation: AI Tax Assist. This advanced conversational AI chatbot is a game-changer, offering users an interactive and informative tax-filing experience. Let’s delve into the intricacies of this cutting-edge technology and how it’s set to revolutionize your approach to tax filing.

Unlocking the Potential of AI Tax Assist:

Exclusively available through the premium tiers of H&R Block’s DIY tax software, AI Tax Assist is engineered to simplify the intricacies of tax regulations. Users now have the power to pose questions on tax rules, exemptions, and various tax-related nuances, receiving instant, precise responses. Beyond this, the AI seamlessly guides users to human tax experts for personalized advice, underscoring H&R Block’s commitment to delivering holistic support.

Knowledge Empowerment at Your Fingertips:

AI Tax Assist distinguishes itself by transcending the traditional role of tax platforms. Instead of mere instructions, it seeks to empower users with a profound understanding of their tax filing process. Through insightful responses, it sheds light on different tax exemptions and clarifies the treatment of assets such as cryptocurrency under the tax code.

Next-Level Personalization with AI-Powered Advice:

While the current setup directs users to human experts, H&R Block is actively working on integrating AI-powered personalized advice directly into the chatbot. This strategic enhancement is poised to elevate the user experience, providing tailored guidance based on individual circumstances.

Building Trust through Transparency:

Recognizing the paramount importance of trust in adopting new technologies, H&R Block adopts a transparent approach. Users are informed upfront about the AI-driven nature of the feature, with banners and sample prompts displayed. This deliberate strategy aims to instill confidence, leveraging the trust users have developed with H&R Block.

Affordable Access to Advanced Technology:

AI Tax Assist is seamlessly integrated into the premium versions of H&R Block’s DIY tax software, starting at an affordable $35. Despite the introduction of this cutting-edge feature, the company assures users that subscription prices remain unchanged.

Tech Collaboration and Rigorous Training:

The development of AI Tax Assist is the result of a collaborative effort between H&R Block, OpenAI, and Microsoft. The chatbot underwent exclusive training using H&R Block’s extensive library of tax laws, further refined with invaluable insights from accountants, lawyers, and tax professionals. Notably, the model is designed to operate without pulling information from the internet, ensuring unparalleled accuracy and reliability.

Ensuring Accuracy and Accountability:

Given the high stakes involved in tax preparation, H&R Block has implemented robust measures to guarantee the accuracy of AI Tax Assist. A dedicated team monitors the model, ensuring its behavior aligns seamlessly with its intended design. Users also can cross-verify information with H&R Block’s live human experts, providing an additional layer of reassurance.

Redefining Tax Filing in the Digital Age:

AI Tax Assist from H&R Block signifies a paradigm shift in the landscape of tax preparation, offering users a seamless, informed, and personalized experience. The integration of AI technology not only enhances user-friendliness but also aligns seamlessly with the evolving needs of taxpayers. As the tax season approaches, consider making AI Tax Assist your indispensable companion for a tax filing journey that is both empowered and effortless.

Also Read: Top 5 Best Uses of ChatGPT for Earning Money

2 thoughts on “Now AI-Assisted Tax Filing is Possible Because of H&R Block”